What to Discover Before Refinancing

Bringing an alternate financial to replace the first is named refinancing. Refinancing is accomplished to let a borrower discover a better appeal name and rates. The first financing is actually paid, making it possible for the second financing becoming created, unlike simply and also make a unique financial and you can throwing away the brand new completely new mortgage. For borrowers that have the ultimate credit rating, refinancing might be the best way to transfer a changeable mortgage price so you’re able to a predetermined, and obtain a lesser interest rate.

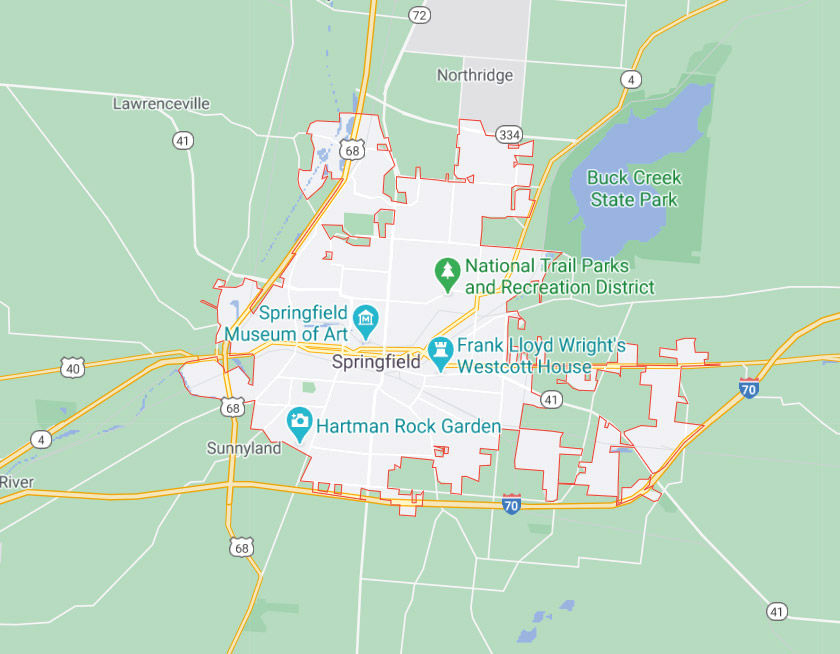

In just about any economic climate, it may be hard to result in the payments with the a house home loan. Anywhere between you can easily higher rates of interest and you can a shaky discount, making home loan repayments becomes more challenging than simply your actually ever questioned. If you end in such a case, it will be time for you consider refinancing. The danger during the refinancing is dependant on ignorance. Without proper knowledge it can in reality hurt you to re-finance, increasing your interest rate unlike lowering it. Less than there are a few associated with the first degree printed in buy so you can reach finally your lowest price. Having comparative motives, we have found a performance dining table showing current pricing in your area.

https://availableloan.net/loans/emergency-payday-loan/

What are the Benefits of Refinancing?

One of the several benefits associated with refinancing aside from security is reducing mortgage loan. Commonly, since anyone function with their jobs and you will still generate so much more money capable pay all their debts timely and therefore increase their credit rating. Using this escalation in borrowing from the bank happens the ability to procure finance from the lower rates, and this many people refinance due to their financial companies for it cause. A lesser interest rate have a profound impact on month-to-month payments, probably saving you a lot of money a-year.

Next, people re-finance to receive money for high commands such as for example trucks or even to lose personal credit card debt. The way they accomplish that is via refinancing with the objective out of taking equity from the home. A house collateral line of credit is actually calculated below. Basic, your house is appraised. Second, the lending company find exactly how much off a share of this assessment he or she is ready to loan. Eventually, the balance due towards brand-new home loan is subtracted. Then money is regularly pay off the initial home loan, the remaining harmony try loaned into the homeowner. Most people boost up on the condition of a house when they buy it. As such, it help the value of the house. By doing so and then make payments towards the home financing, these people are able to take out substantial domestic equity outlines out-of credit while the difference between the newest appraised value of the domestic increases therefore the harmony owed into the home financing decreases.

- Assist having People There’s been previous laws and regulations from refinancing. Take a look and you may discover the liberties.

- Residence is Where Security Is A report on the importance and you may procedure of building guarantee.

- Home Affordable Re-finance Program The newest programs are around for make it easier to re-finance.

- Improve Their FHA Mortgage This unique sort of mortgage could be extremely advantageous to the brand new citizen trying to re-finance.

- Refinancing Is generally More pricey than simply Do you really believe The fresh new invisible costs and fees off mortgage refinancing, even though discover lower interest levels.

What is actually Refinancing?

Refinancing is the process of obtaining a special mortgage during the an enthusiastic effort to attenuate monthly premiums, lower your interest rates, need cash out of your house to own high purchases, or change mortgage organizations. People re-finance when they’ve equity on the domestic, the difference between extent due to the financial company and value of our home.