If you find yourself just like me, you prefer perusing the news headlines. If perhaps you were enjoying or understanding information shops has just, maybe you have seen a statement regarding the U.S. Company off Homes and you may Urban Invention (HUD) showing an activity that can build homeownership less costly and available to have doing work someone and you can parents.

Toward , HUD reduced new annual mortgage insurance fees (MIP) for homebuyers acquiring a national Housing Power (FHA) loan. The fresh new prevention brings the fresh new superior away from 0.85 per cent to 0.55 percent for most FHA individuals, at some point delivering total discounts and you can permitting more individuals qualify for a beneficial mortgage.

It throws more individuals on the way to owning a home, in which it subscribe many other people who is excited, but unnerved, of the home financing techniques, and particularly by FHA finance. FHA money are one of the common home financing alternatives, however they are commonly misinterpreted. Understanding the principles about any of it prominent version of loan may help you, your loved ones as well as your family members whenever going into the market to get property.

1. What’s an FHA financing?

Put another way, a keen FHA financing is actually financing which is backed, otherwise insured, from the Government Housing Power. The fresh new FHA actually administers numerous form of finance, but we are going to focus on the conventional financial, that’s most likely just what pops into their heads when you pay attention to FHA mortgage.

Are clear, this new FHA cannot give the bucks. Discover an enthusiastic FHA mortgage, you must run a prescription lender, such as for instance Financial out-of Utah.

To add a brief bit of records: Ahead of 1934, people was required to rescue adequate money to include an excellent fifty percent advance payment to their household. Most people wouldn’t. Congress created the Federal Casing Authority for the 1934 and you will introduced the latest National Casing Act a similar seasons, and this supported and also make homes and mortgage loans a whole lot more accessible and you may reasonable.

Loan providers sustain reduced risk that have FHA finance because, based on HUD, the FHA will pay a state they the lending company into unpaid dominant harmony of a great defaulted home loan, if the a debtor fails to generate money. Given that funds try insured, the borrowing requirements getting FHA funds is smaller stringent than other sort of lenders, placing home ownership close at hand for those who have quicker-than-finest borrowing or not sufficient cash on give to possess a big advance payment.

- Reduce percentage requirements

- Down fico scores criteria

- Higher restriction personal debt-to-income proportion criteria (calculated by breaking up your complete month-to-month personal debt repayments by the gross monthly money)

- Reasonable rates of interest

- Zero prepayment punishment (definition you might pay-off their financial at any time, fee-free)

step 3. Whom qualifies getting a keen FHA loan?

FHA finance is popular with basic-go out homebuyers, however, the truth is, the fresh new FHA usually ensure mortgage loans for your first quarters, whether it is very first house or otherwise not. So you can be eligible for an enthusiastic FHA financing by way of Lender away from Utah, eg, borrowers need:

- Complete a credit card applicatoin, that have a legitimate Public Security matter, address or other contact details.

- Ensure the financing can be used for a first house.

- Render good proven a job records during the last 24 months.

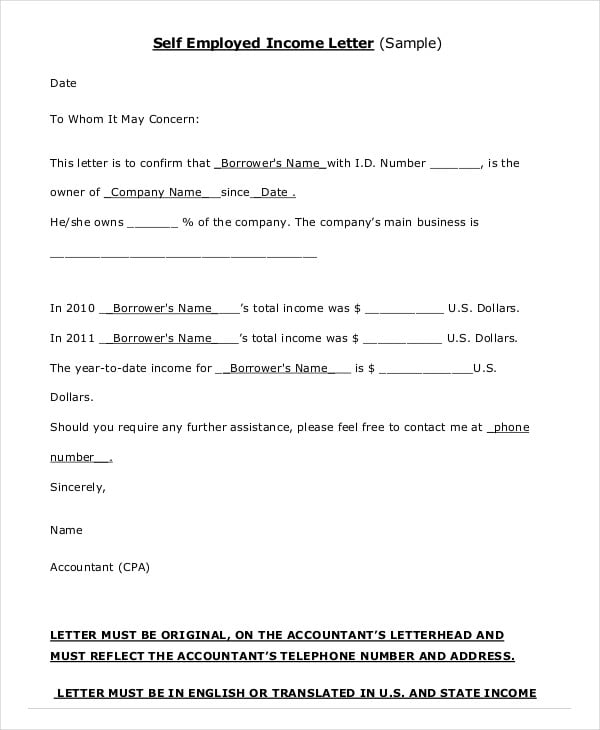

- Make certain money.

In , the latest FHA prolonged financing eligibility to people categorized as the which have Deferred Action to have Child Arrivals updates, labeled as DACA, otherwise Dreamers. DACA borrowers should provide a valid Social Defense number. They need to also provide a legitimate A position Authorization Document awarded by the You.S. Citizenship and Immigration Characteristics, together with match the kept standards in the above list.

cuatro. Preciselywhat are other considerations while looking on the FHA financing?

:max_bytes(150000):strip_icc()/VenmoAddMoney1-37b88c2b2dba4235a863688991c15d34.jpg)

FHA guidelines were limitations for the price of residential property, dependent on city, and you may mandatory inspections to make certain home fulfill certain protection requirements (which in the conclusion could work for the best and you may save you from and work out detailed solutions which will damage your financial budget).

The biggest attention having FHA loans is the upfront and yearly financial insurance premiums (MIP), and help manage loan providers away from losses. The newest upfront MIP will set you back step one.75 per cent of your FHA financing and certainly will getting financed into the the loan in itself. The fresh new annual MIP payment may vary according to your loan count and you may title, and is built-up monthly inside your financing percentage.

As mentioned earlier, the government are decreasing the yearly MIP away from 0.85 % so you can 0.55 % for the majority FHA consumers, energetic to have FHA finance closed to your or shortly after ple, somebody to acquire one home which have an effective $265,000 home loan will save you just as much as $800 in the 1st seasons of its home loan. For a mortgage out of $467,700 – the fresh federal average home rates as of – the brand new cures could save your house consumer more $step one,400 in the first season.

Even after the fresh new reduction in annual MIP, it element of an FHA loan should be considered carefully. That question to ask on your own is: Must i rating another kind of loan immediately you to will not is MIP, or do I merely be eligible for an enthusiastic FHA loan that includes MIP? For those who simply be eligible for a keen FHA financing, you could possibly get rid of the financial insurance coverage fee in the future because of the refinancing to some other kind of loan in the event your credit is the most suitable or when you have more cash.

An upfront Insights Renders To invest in a home More enjoyable

Fundamentally, FHA loans might be high units to own customers, plus they helps you reach finally your payday loans online Eufaula AL dream of to be a beneficial resident.

While you are looking to buy a property, sit and you will have a look at their barriers and opportunities. Do lookup. There are a number of programs and you may grants to aid homebuyers. At the Financial out of Utah, such as for instance, i have access to our home$tart offer, which can promote a finite number of money to possess eligible first-date homebuyers to go with the the purchase off a property. That grant can be used that have FHA money.

Usually make inquiries. Despite the suggestions I have given here, the process can nevertheless be overwhelming. It’s a good idea to inquire about financing officer in advance than simply be blown away for the software process. Anyway, to acquire property can be pleasing, perhaps not excessively exhausting.

Eric DeFries is the Older Vice-president, Residential Lending, for Bank from Utah. Originally out of Layton, he’s got experienced the new finance globe to possess sixteen years and having Lender out of Utah having twelve many years. He suits for the Panel regarding Commissioners with the Ogden Homes Expert. Inside the sparetime, Eric has actually to try out and you may watching football, take a trip, and hanging out with his friends and family.