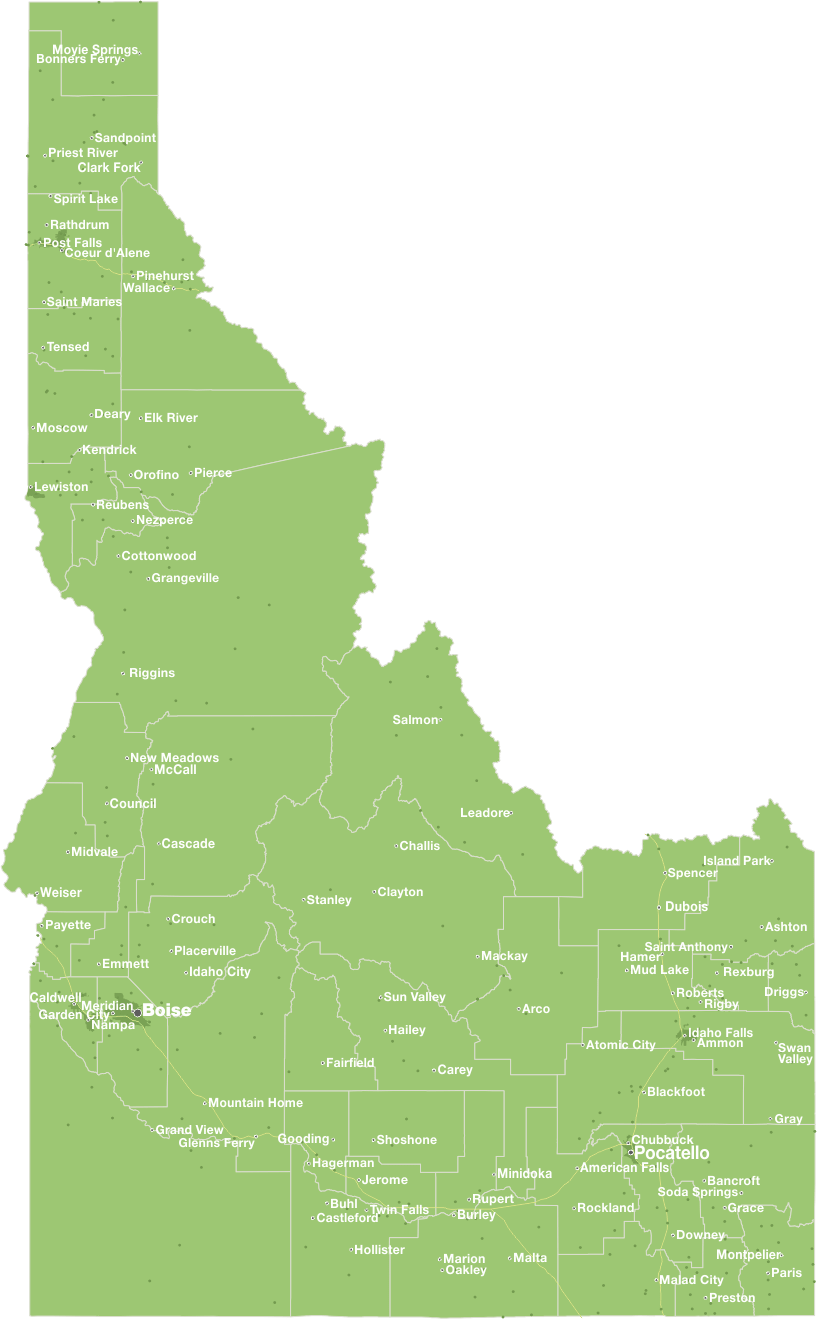

If you want to end up being a resident within the a rural area, USDA Finance give outstanding path on the and work out you to fantasy a beneficial facts. This type of bodies-backed mortgages are specially made to offer reasonable homeownership exterior significant cities.

Whether you are a first-day homebuyer, dream about more room for your family, or simply just want to refrain the hustle and bustle out-of urban area lifetime, USDA Fund bring powerful positives.

What makes USDA Funds be noticeable? He’s specifically good for those people not able to save up a good higher down-payment. However they provide competitive interest levels and versatile borrowing from the bank advice, stretching homeownership possibilities to a greater variety of buyers.

Contained in this book, we’re going to research the big benefits of USDA Money, describing as to the reasons they might be an effective selection for of a lot consumers.

A portion of the Benefits associated with USDA Loans

Let’s look at the secret benefits of USDA Finance and exactly how capable open the door for you having your cut of country side.

One of several great things about USDA Fund ‘s the over removal of the new down payment challenge. For almost all potential home owners, especially earliest-big date people , racking up a substantial advance payment can feel like a keen insurmountable test.

Conventional Financing generally speaking want a down payment between step three% and you may 20% of the complete cost, which can convert in order to tens and thousands of bucks – money many people merely lack offered.

After you submit an application for a good USDA Financing , you dump that it barrier completely. With no down payment expected, you could potentially funds the complete price of eligible rural household through the USDA Mortgage program, releasing your coupons with other expenses pertaining to homeownership, such chairs, devices, otherwise moving will set you back. it may notably replace your month-to-month cash flow, because you won’t need to spend some financing into a giant off payment before getting into your fantasy household.

The key takeaway here’s one while the USDA Finance take away the importance of a down-payment, they generate homeownership within the outlying section a much more attainable options. This work for is particularly advantageous getting earliest-big date homebuyers and the ones that have restricted deals.

2petitive Interest levels

Beyond the independence from bypassing a down-payment, USDA Loans provide another important monetary advantage: aggressive rates of interest. When it comes to mortgage loans, the speed was an important component that determines their month-to-month commission in addition to total cost out-of credit over the longevity of the loan.

The rate was a share of your amount borrowed you spend towards the bank over time towards privilege regarding borrowing from the bank currency. For example, when you yourself have an amount borrowed of $100,000 and you may an interest rate of 5%, you’ll spend $5,000 a year into the focus.

Therefore, what makes USDA Funds typically added to straight down interest rates? Mainly because money was insured because of the You Agencies out-of Agriculture , lenders perceive all of them https://paydayloansconnecticut.com/inglenook/ while the much safer. So it bodies backing allows loan providers to provide so much more competitive cost opposed so you can Old-fashioned Money your bodies will not insure.

Here is how so it work with usually means genuine discounts. As USDA Financing will often have straight down interest rates than just Traditional Funds, it results in less monthly homeloan payment and you may probably numerous away from several thousand dollars stored over the course of the mortgage. Its for example bringing a built-within the write off in your mortgage.

step three. Flexible Credit Advice

For the majority of potential homebuyers, a primary matter on home loan software techniques is the credit rating . Your credit rating is a numerical icon of your own creditworthiness founded on your own prior credit and you may installment background.

Antique loan providers often have tight credit score requirements, so it is burdensome for people who have quicker-than-perfect borrowing to help you qualify for a home loan. Those individuals lenders like to see that you know how to get and sustain a confident credit history . Without a doubt, not everyone can do that.